Understanding Emotional Decision-Making in Stock Trading

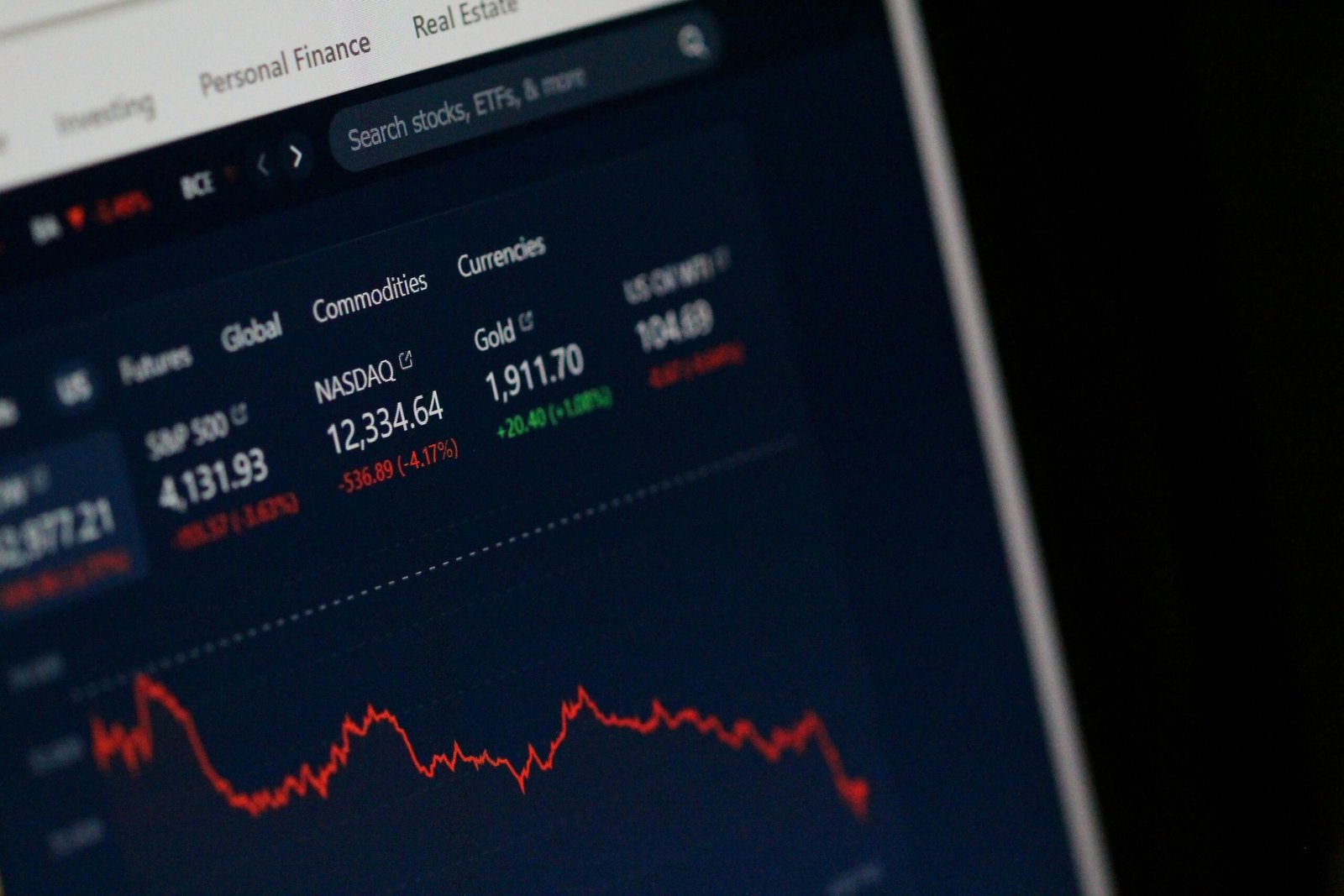

Emotional decision-making plays a pivotal role in the realm of stock trading, often leading investors to act impulsively and make irrational choices. The stock market, characterized by its volatility, can significantly heighten feelings of fear and greed, which are two primary emotions that influence trading behaviors. When investors witness a sudden market downturn, fear may compel them to sell their shares hastily, often resulting in greater losses than anticipated. Conversely, during a market rally, the feeling of greed can push traders to make overly risky investments, driven by the allure of quick profits.

The impact of these emotions extends beyond individual decision-making, as they can also alter overall market behavior. For instance, during periods of market euphoria, investor enthusiasm may create a bubble effect, leading to inflated stock prices that eventually correct. This phenomenon illustrates how collective emotional reactions can drive market trends, often detached from fundamental valuations. Additionally, psychological biases such as loss aversion and overconfidence further complicate investors’ perceptions. Loss aversion leads traders to prioritize potential losses over equivalent gains, which can hinder their willingness to take calculated risks necessary for success in trading.

Overconfidence, on the other hand, may cause traders to underestimate risks associated with specific stocks, resulting in poor judgment and significant financial consequences. To navigate these challenges, self-awareness and emotional control become critical. Recognizing one’s emotional triggers can aid traders in maintaining a rational approach when making investment decisions. Techniques such as establishing a solid trading plan, setting predetermined entry and exit points, and practicing mindfulness can enhance emotional regulation. By understanding the intricacies of emotional decision-making in stock trading, investors can better position themselves for making informed and strategic choices within the market.

Common Mistakes Investors Make Due to Emotions

Emotions play a significant role in the decision-making processes of stock traders, often leading to detrimental mistakes. One common error is panic selling during market downturns. For instance, consider an investor who has held shares in a technology company. When a sudden economic downturn arises, causing the stock to drop sharply, the investor may react by selling all his shares in a state of fear. This impulse is driven by the emotional desire to cut losses, rather than a rational assessment of the company’s fundamentals. Unfortunately, such actions often result in realizing losses that could have been avoided if the investor had maintained a steady outlook.

Another prevalent mistake is chasing “hot stocks” due to the fear of missing out (FOMO). An individual observing dramatic price increases in popular companies may hastily purchase shares after seeing viral news or social media hype. This emotional urge to join the market momentum may lead to buying at inflated prices, ultimately resulting in significant financial losses when the stock price corrects. For example, after a famous celebrity endorses a start-up, inexperienced investors might jump in without proper due diligence, only to find themselves on the losing side when the initial excitement fades away.

Emotional attachment can also cause investors to hold onto losing positions longer than warranted. A trader may refuse to sell a declining stock, convinced that it will eventually recover, often due to personal sentiments or previous investments in the company. This stubbornness can lead to missed opportunities elsewhere, diverting resources from potentially profitable investments. Recognizing these behavioral biases is crucial for investors aiming to cultivate a more disciplined trading strategy. Being aware of emotional decision-making is the first step toward mitigating its adverse effects in stock trading.

Strategies to Manage Emotions in Trading

In the fast-paced world of stock trading, managing emotions is crucial for making sound decisions and achieving long-term success. One effective strategy is to establish a clear trading plan. This plan should outline specific goals, risk tolerance, and methodologies, providing a structured approach that can guide decisions during emotionally charged market conditions. By having a plan in place, traders are less likely to deviate from their intended strategies and can minimize impulsive reactions driven by fear or greed.

Another vital component of emotional management in trading is to set predefined entry and exit points. By determining these levels ahead of time, traders can avoid the emotional turmoil associated with real-time decision-making. This technique not only creates clarity but also helps traders adhere to their strategies, allowing them to act with conviction when they enter or exit trades, rather than being swayed by transient market fluctuations.

Employing stop-loss orders is equally important in managing trading emotions. A stop-loss order automatically sells a security when it reaches a specified price, effectively limiting potential losses. This tool alleviates the emotional burden of holding onto losing positions in hopes of a market recovery. When used correctly, stop-loss orders serve as a safety net, instilling confidence in traders as they navigate uncertain market conditions.

Furthermore, journaling is an underutilized but impactful strategy. By consistently tracking emotions, decisions, and the outcomes of trades, traders can develop a clearer understanding of their emotional patterns and triggers. This reflective practice aids in recognizing moments of emotional bias, enabling traders to refine their processes and improve decision-making. Additionally, incorporating mindfulness techniques—such as meditation or breathing exercises—can foster emotional resilience, promoting a disciplined approach that minimizes impulsive behavior during trading activities.

Implementing these strategies allows traders to create a balanced trading environment where emotions won’t dictate actions, ultimately leading to more informed and calculated trading decisions.

Building a Rational Decision-Making Framework

In the world of stock trading, establishing a rational decision-making framework is crucial for achieving consistent success. Emotions, such as fear and greed, often cloud judgment, leading to impulsive decisions that can negatively impact portfolios. To counteract this, traders should develop a systematic approach grounded in thorough research and analysis.

One effective method for analyzing potential investments is fundamental analysis. This approach focuses on assessing a company’s financial health through the examination of its earnings, revenue, and overall market position. By understanding key performance indicators, traders enhance their ability to make informed decisions based on factual data rather than emotional responses. Similarly, technical analysis complements this by examining historical price movements and trading volumes. Utilizing charts and patterns, traders can identify trends and forecast future price fluctuations, which is essential for executing timely trades.

Furthermore, having a mentor can significantly enhance an investor’s decision-making process. A knowledgeable mentor offers guidance and shares insights drawn from personal experience, thereby providing a valuable perspective that can help mitigate emotional biases. This relationship encourages traders to question impulsive thoughts and align their strategies with rational analysis.

Another growing trend in the trading landscape is the adoption of automated trading systems. These algorithms execute trades based on predefined criteria, removing the emotional component from the trading process. By relying on data-driven strategies, automated systems can help traders stick to their plans without succumbing to momentary market fluctuations.

Ultimately, by prioritizing thorough research, leveraging mentorship, and considering automated systems, traders can establish a robust decision-making framework that fosters informed investment choices. This structured approach not only minimizes the risk of emotional mistakes but also enhances overall trading effectiveness.