Introduction to Stock Market Trends

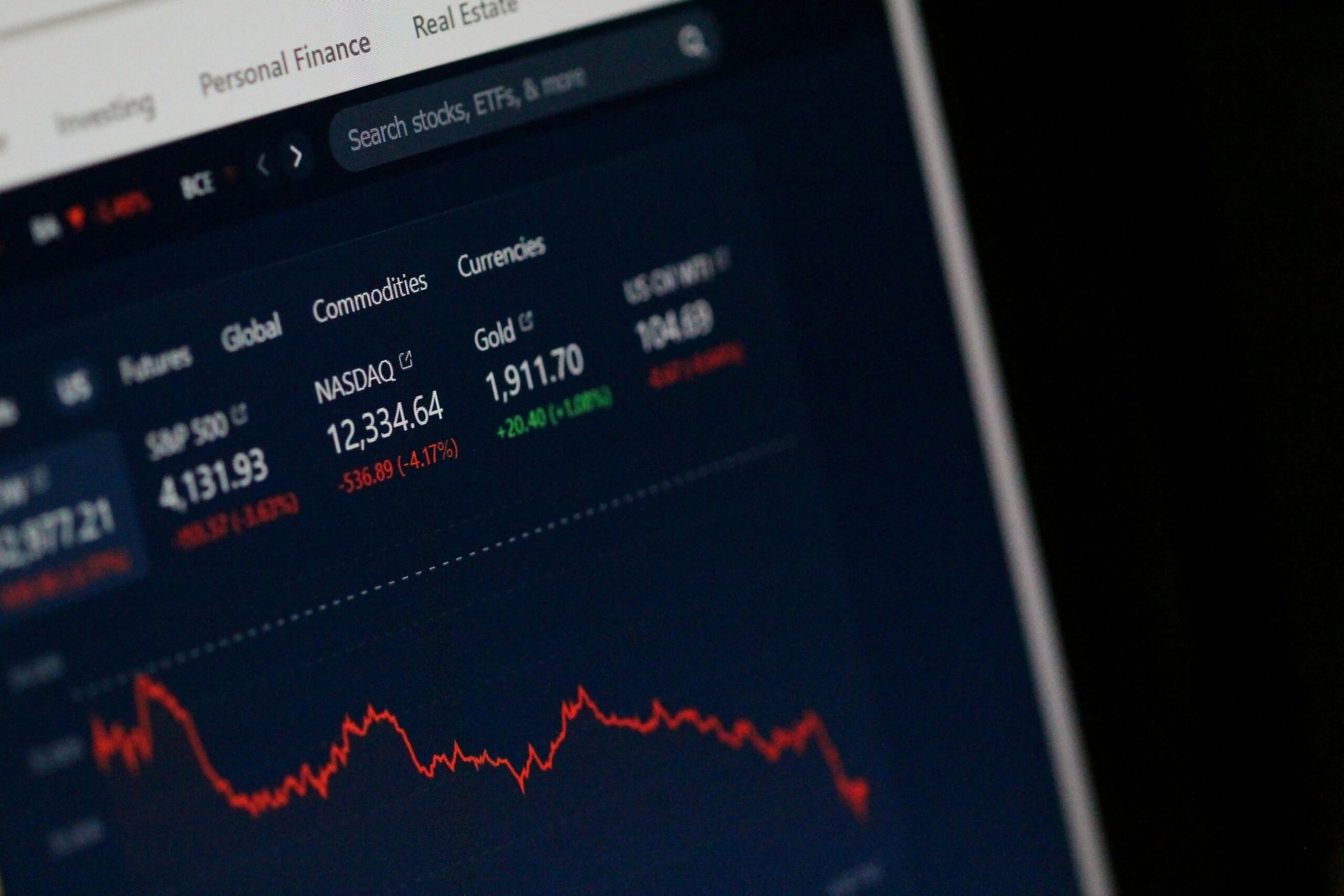

The stock market, a critical component of the global economy, reflects the health and outlook of various industries, influenced by numerous external factors. Currently, the market is experiencing a period of uncertainty, with fluctuations driven by evolving economic conditions, changing government policies, and rapid technological advancements. Understanding these dynamics is crucial for both novice and seasoned investors as they formulate strategies for the upcoming years.

Economic conditions play a pivotal role in shaping market trends. Indicators such as interest rates, inflation, and employment levels serve as barometers for overall economic health, affecting consumer spending and, consequently, corporate performance. The current environment suggests a cautious optimism, as central banks are navigating the delicate balance between stimulating growth and controlling inflation. Investors are keenly observing these economic indicators to make informed decisions that could influence their portfolios significantly.

Government policies also significantly impact the stock market. Legislative decisions regarding taxation, trade agreements, and regulatory measures can create ripples across industries. For example, stimulus packages may boost certain sectors, while restrictive regulations can hinder growth. As we look towards 2025, it is essential to evaluate how potential policy shifts may affect industry performance, creating both challenges and opportunities for investors.

Furthermore, technological advancements are reshaping the marketplace, accelerating innovation in areas such as artificial intelligence, renewable energy, and biotechnology. These sectors are expected to experience substantial growth, attracting investment as companies leverage new technologies to enhance efficiency and create competitive advantages. Overall, grasping these trends is vital for understanding the stock market’s trajectory and making prudent investment choices in a changing environment. As we move towards 2025, a well-rounded approach that considers these multifaceted aspects will be essential for strategic investment placement.

Key Industries Poised for Growth

As we look towards 2025, several key industries are set to experience significant growth driven by technological advancements, changing consumer behaviors, and emerging market trends. Among these, the technology sector stands out, particularly areas such as artificial intelligence (AI) and cybersecurity. The rapid integration of AI across various applications is expected to optimize processes and facilitate data-driven decision-making. This will create new opportunities for businesses and individuals alike. Cybersecurity, on the other hand, continues to gain importance as digital attack vectors proliferate, necessitating robust security solutions to protect sensitive information.

Another promising industry is renewable energy. The global shift towards sustainability is fueled by the increasing demand for cleaner energy sources. As governments worldwide implement stricter regulations to combat climate change, sectors such as solar and wind energy are anticipated to flourish. Investments in innovative technologies and infrastructure developments are likely to boost efficiency and reduce costs, making renewable energy sources more appealing to consumers and businesses.

The healthcare industry is also poised for remarkable growth, propelled by advancements in medical technology and an increasing aging population. Telehealth services, personalized medicine, and biotechnology are some key trends that are transforming the healthcare landscape. As people seek accessible and efficient healthcare solutions, the demand for innovative treatment options will continue to rise, ultimately enhancing patient care.

Lastly, e-commerce is experiencing a notable surge, driven by shifts in consumer purchasing habits. The convenience of online shopping and the rise of mobile payment solutions are contributing to this trend. Retailers are increasingly embracing omni-channel strategies to enhance customer experience, further solidifying e-commerce’s role in the modern marketplace. As the integration of technology continues to reshape these industries, they will likely become significant contributors to economic growth by 2025.

Investment Strategies for 2025

As we look forward to the stock market outlook for 2025, it is essential for investors to formulate effective investment strategies that align with anticipated growth in key industries. An increasingly complex economic landscape necessitates a comprehensive approach that incorporates diversification, risk management, and staying informed about market trends. One of the first steps investors should take is to assess the industries poised for growth, such as technology, renewable energy, and healthcare. These sectors are expected to benefit from evolving consumer behaviors and advancing technologies, providing ample opportunities for investors.

Diversification remains a fundamental tenet of successful investing. By spreading capital across various sectors, investors can mitigate risks associated with market fluctuations and industry-specific challenges. Allocating resources to both high-growth and more stable sectors can create a balanced portfolio, allowing investors to capitalize on upward trends while safeguarding against potential downturns. It is crucial that investors continuously evaluate their portfolios, adjusting allocations based on changing market dynamics and emerging opportunities.

Risk management also plays a pivotal role in shaping investment strategies. Investors should conduct thorough research on potential investments and consider the inherent risks of specific industries. Utilizing risk assessment tools such as volatility measures and correlation coefficients can offer insights into how different investments interact under varying market conditions. Setting clear risk tolerances and exit strategies will empower investors to make informed decisions while navigating the complexities of the stock market.

Furthermore, staying informed is vital. Regularly monitoring financial news, industry reports, and economic indicators will enable investors to anticipate shifts in market trends. By leveraging analytical tools and investment platforms, individuals can track performance metrics of industries in which they are invested. Keeping abreast of developments empowers investors to make timely and strategic adjustments to their portfolios, enhancing potential returns and fostering long-term growth in accordance with the evolving market landscape.

Challenges to Anticipate

As we glance towards the stock market outlook for 2025, it is essential to consider the potential challenges that may arise for investors targeting high-growth industries. Understanding these challenges can provide crucial insights, helping investors shape their strategies effectively amidst economic fluctuations.

One of the foremost risks is economic uncertainty, which can stem from various factors including shifts in global economic conditions, changes in consumer spending, and fluctuations in commodity prices. For instance, geopolitical tensions or trade disputes can create a ripple effect, leading to reduced investor confidence and slowed economic growth. Such uncertainties can substantially impact industries poised for expansion, making it imperative for investors to thoroughly analyze external economic indicators and trends to gauge their potential risks.

Regulatory changes also present a significant challenge for industries anticipating growth. The evolving landscape of government policies and regulations can directly influence sectors such as technology, healthcare, and renewable energy. Compliance with new regulations may involve considerable costs and adjustments, potentially hampering profitability and growth. Investors must remain vigilant regarding policy proposals and regulatory updates that could affect their investments. Staying informed about legislative trends will allow them to forecast potential impacts on their portfolios effectively.

In addition to economic and regulatory challenges, market volatility is another consideration. Sudden market fluctuations can arise from factors such as changes in interest rates, inflationary pressures, or unforeseen events, like global pandemics. Such volatility can lead to dramatic price swings in stocks, even in growth-oriented sectors. To navigate this uncertainty, investors should adopt a diversified investment strategy, balancing their portfolios to mitigate risks while capitalizing on potential growth opportunities.

By recognizing these challenges, investors can better prepare for the dynamic investment landscape that lies ahead in 2025, making informed decisions that align with their financial goals. Adopting a proactive approach can help them address potential pitfalls while pursuing opportunities for growth in promising industries.